PODERcard - Mobile Banking App

PODERcard is a digital neobank providing financial access to underserved Hispanic communities in the U.S., offering a mobile banking app and debit/credit cards designed for users with varying levels of financial literacy.

Company:

Welcome Tech

Role:

Product Designer

Year:

2023

Company:

Welcome Tech

Role:

Product Designer

Year:

2023

Framing the Problem

PODERcard faced challenges affecting user experience, including complex onboarding, language barriers, and accessibility issues.

Users struggled with essential tasks like account setup due to unfamiliar banking terminology, highlighting the need for simplified user interactions and improved financial literacy support.

PODERcard faced challenges affecting user experience, including complex onboarding, language barriers, and accessibility issues.

Users struggled with essential tasks like account setup due to unfamiliar banking terminology, highlighting the need for simplified user interactions and improved financial literacy support.

Designing a solution

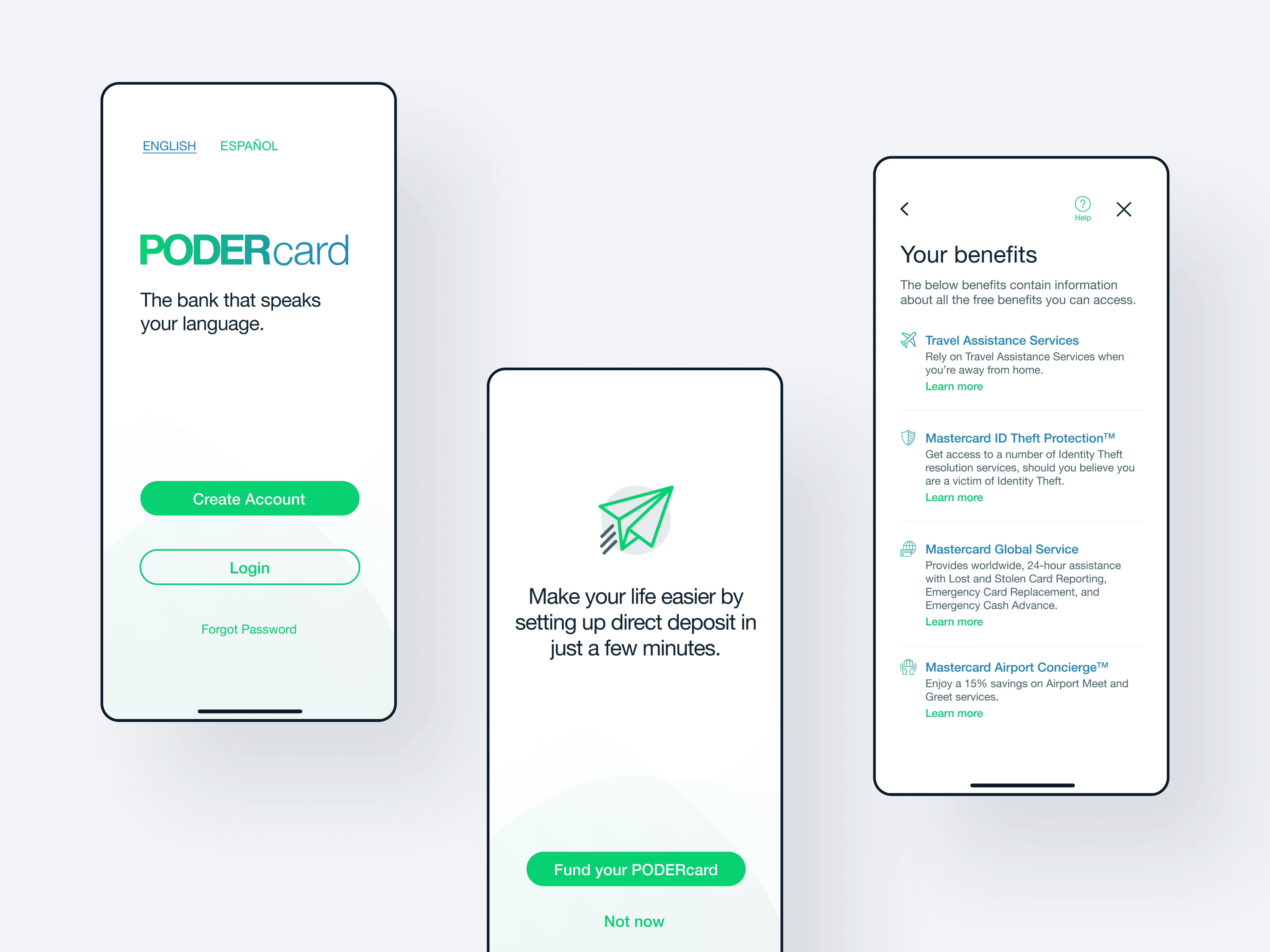

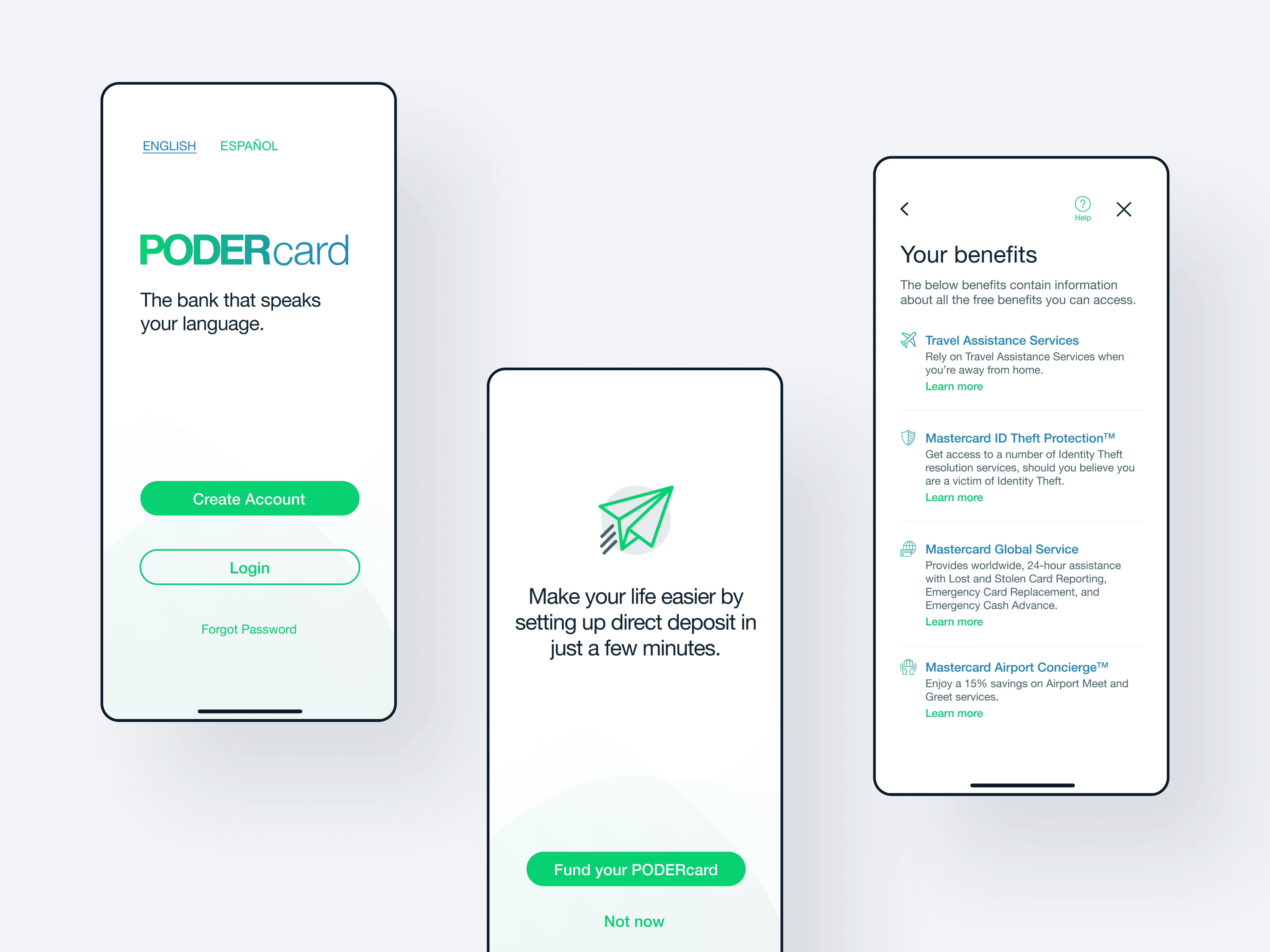

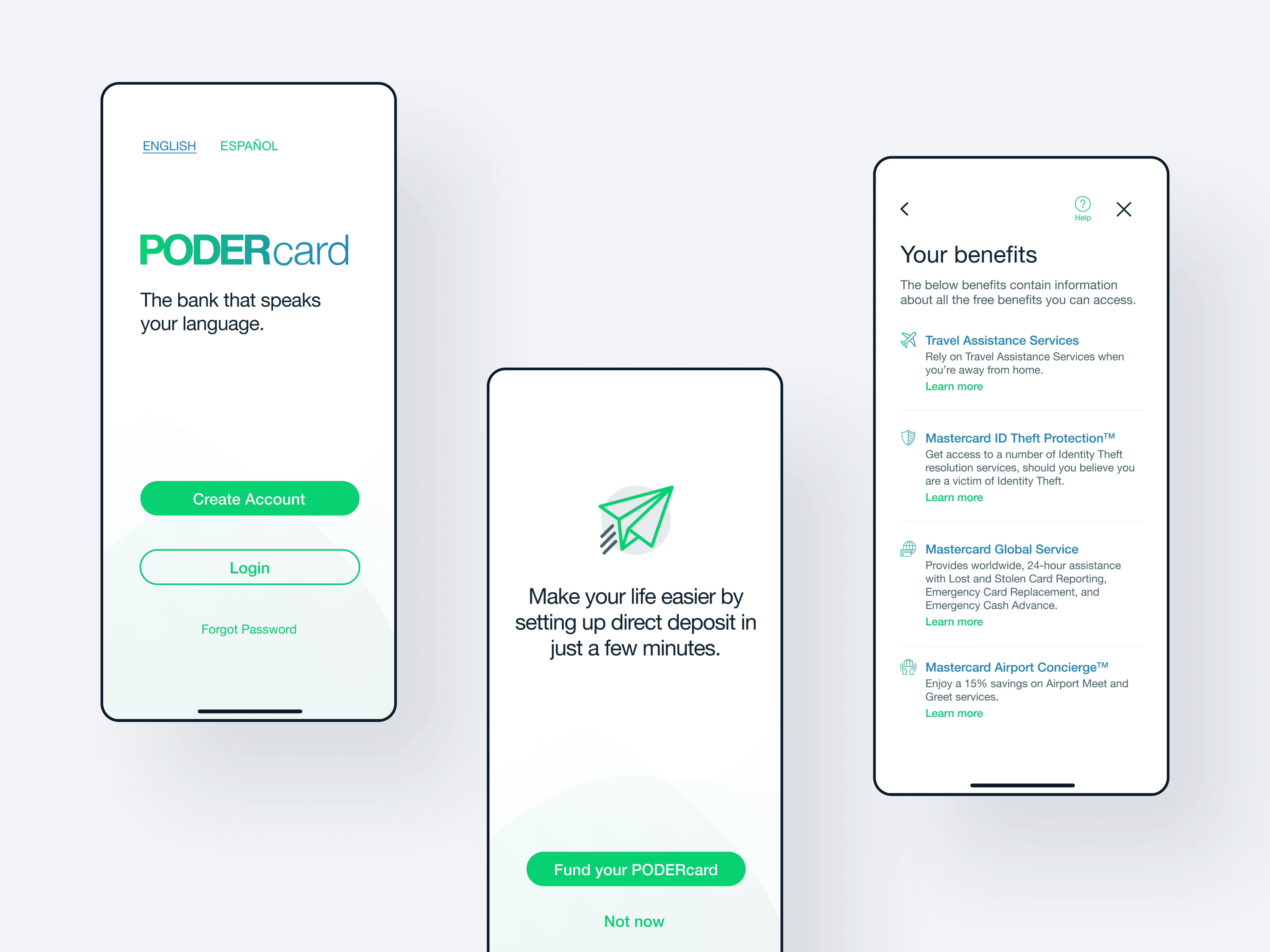

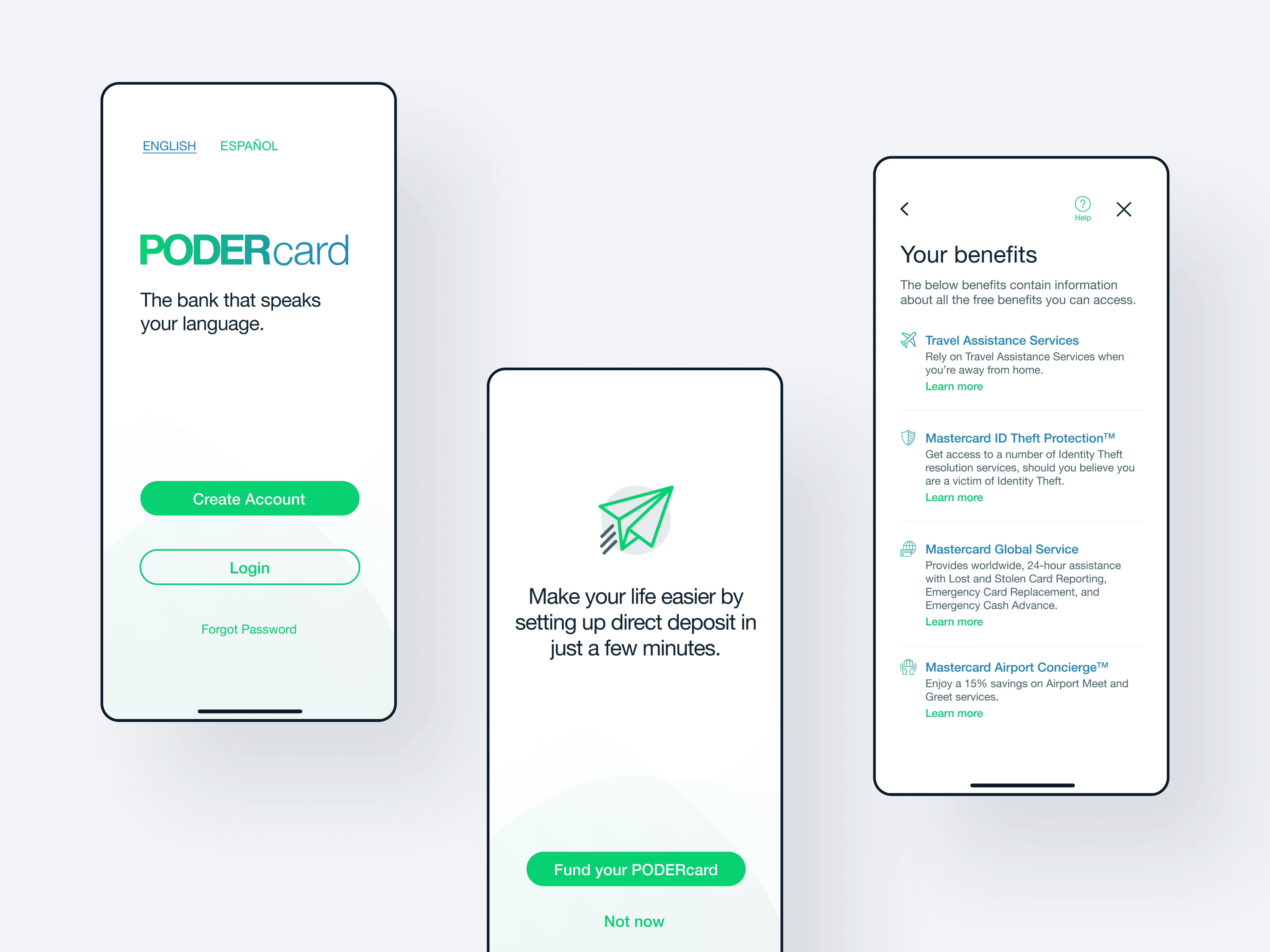

I aimed to design straightforward interactions that engage users and accommodate varying levels of financial literacy.

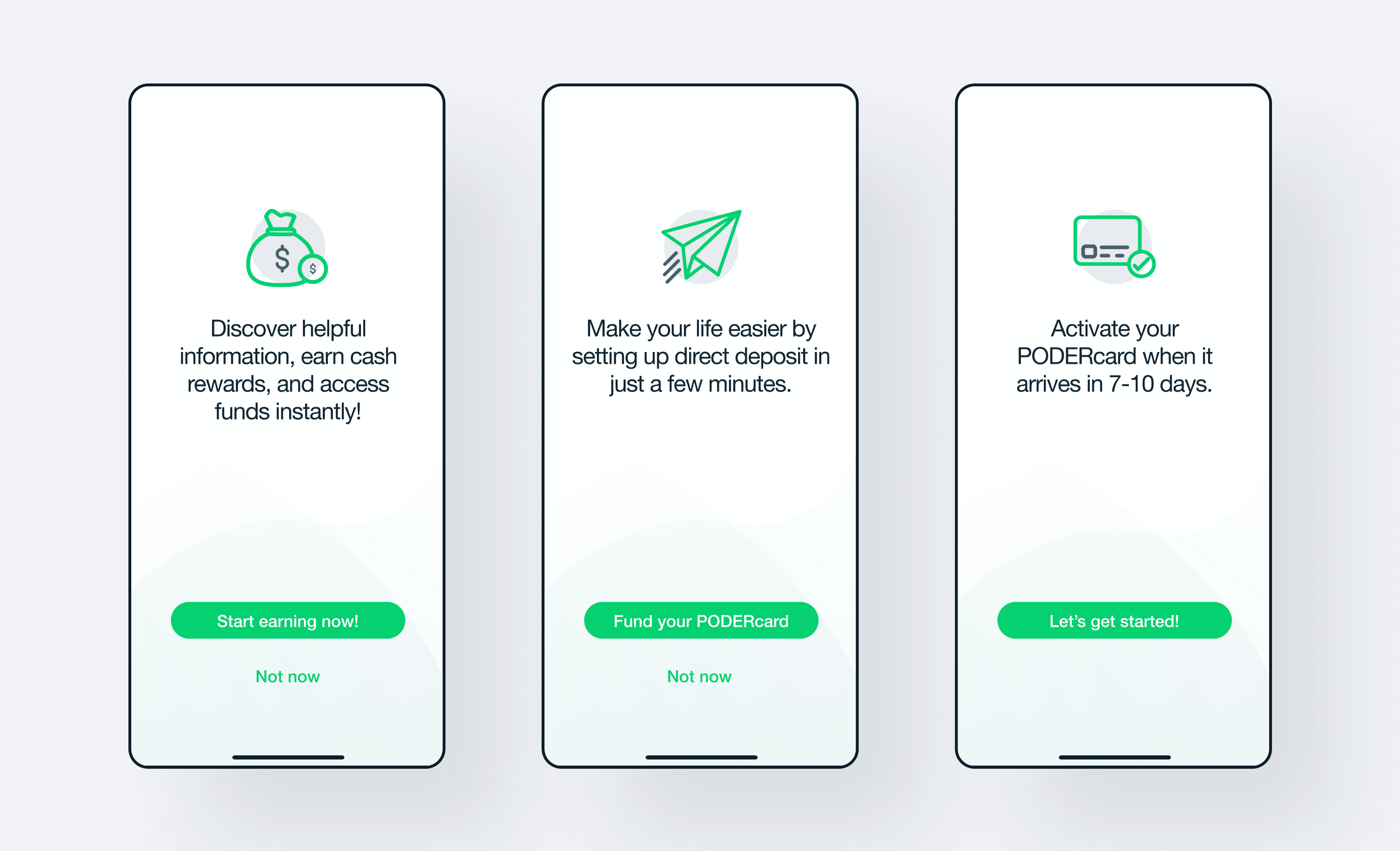

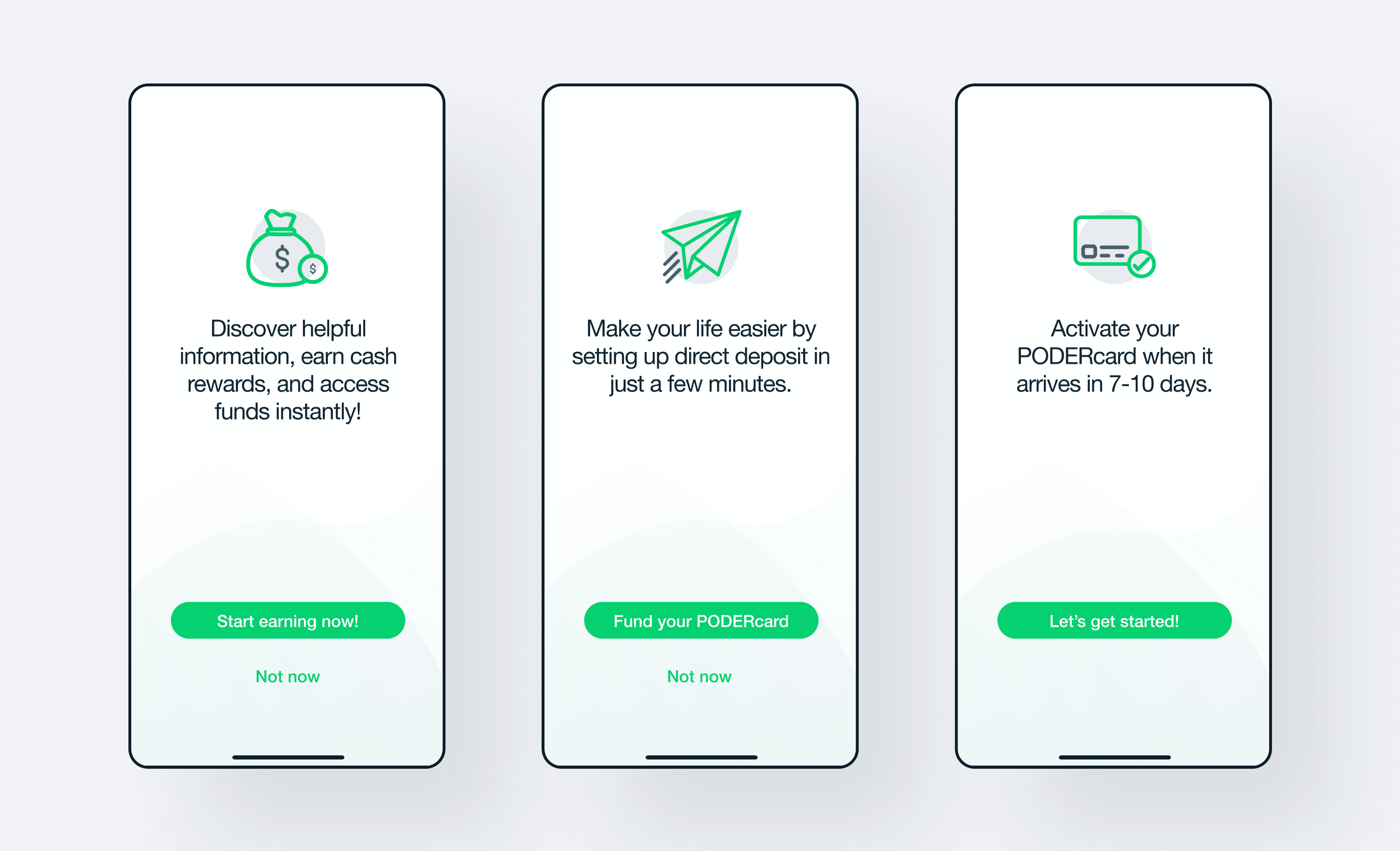

First Time User Experience (FTUX): Developed clear screens for account creation and login, guiding users through setup with essential information.

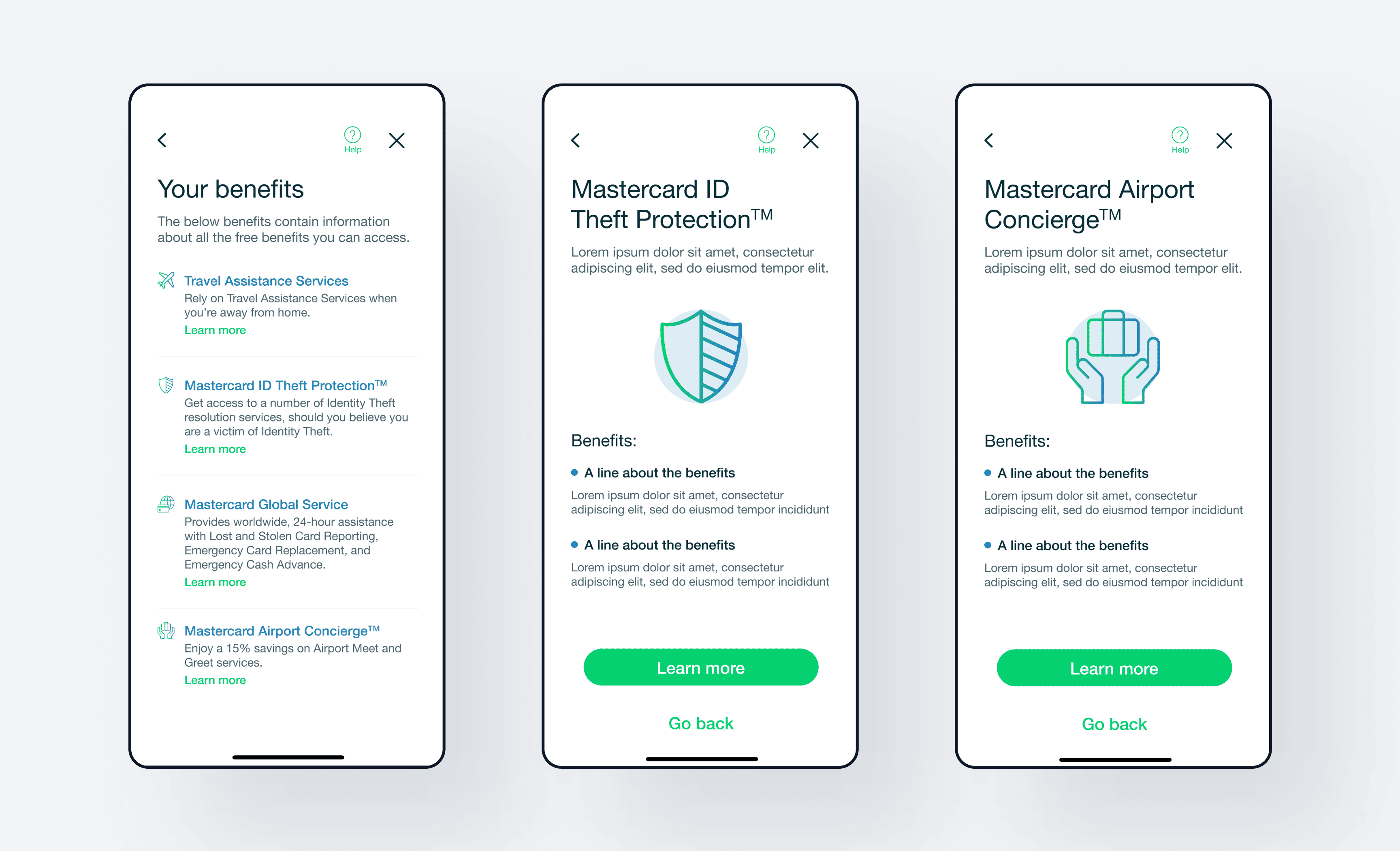

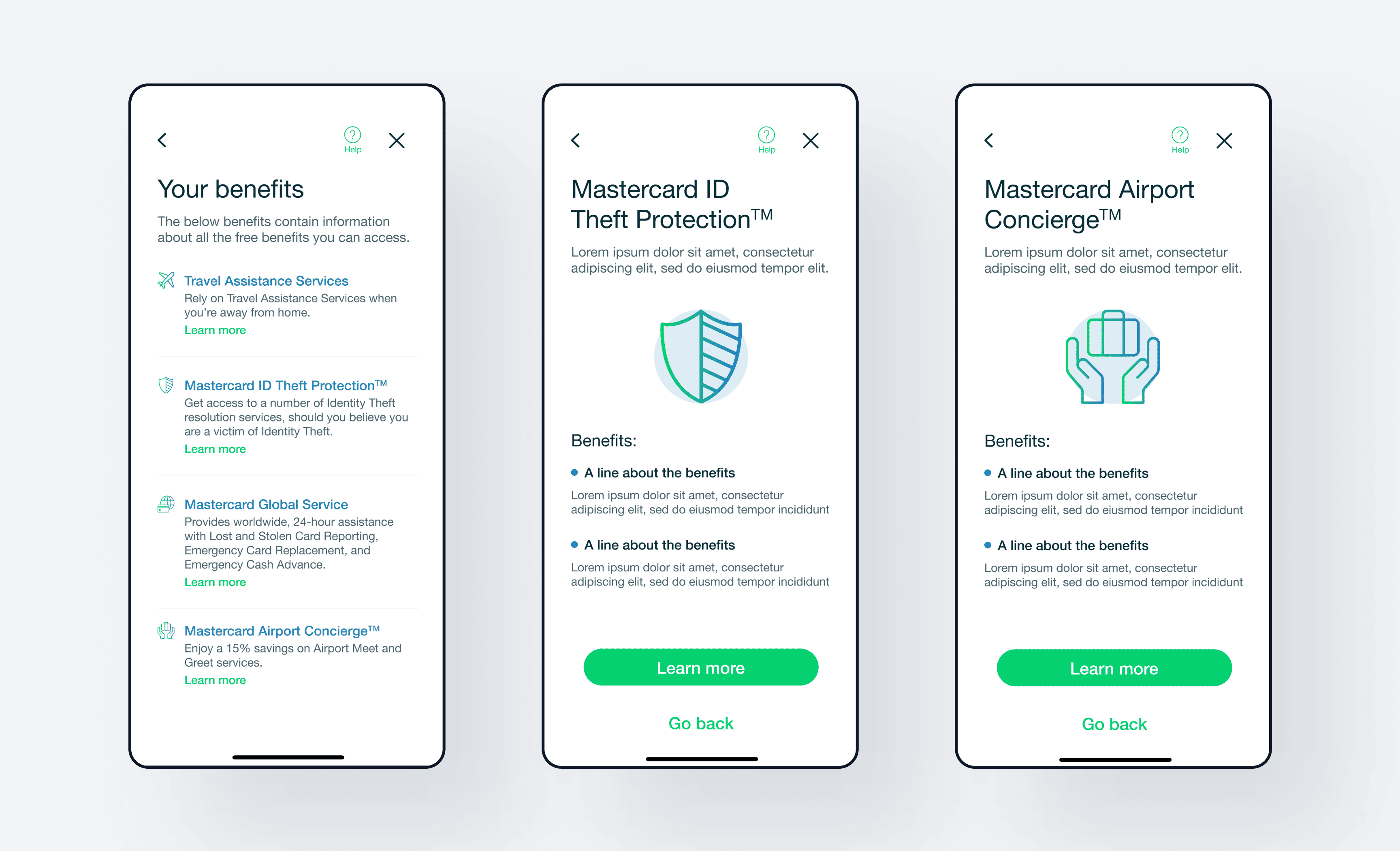

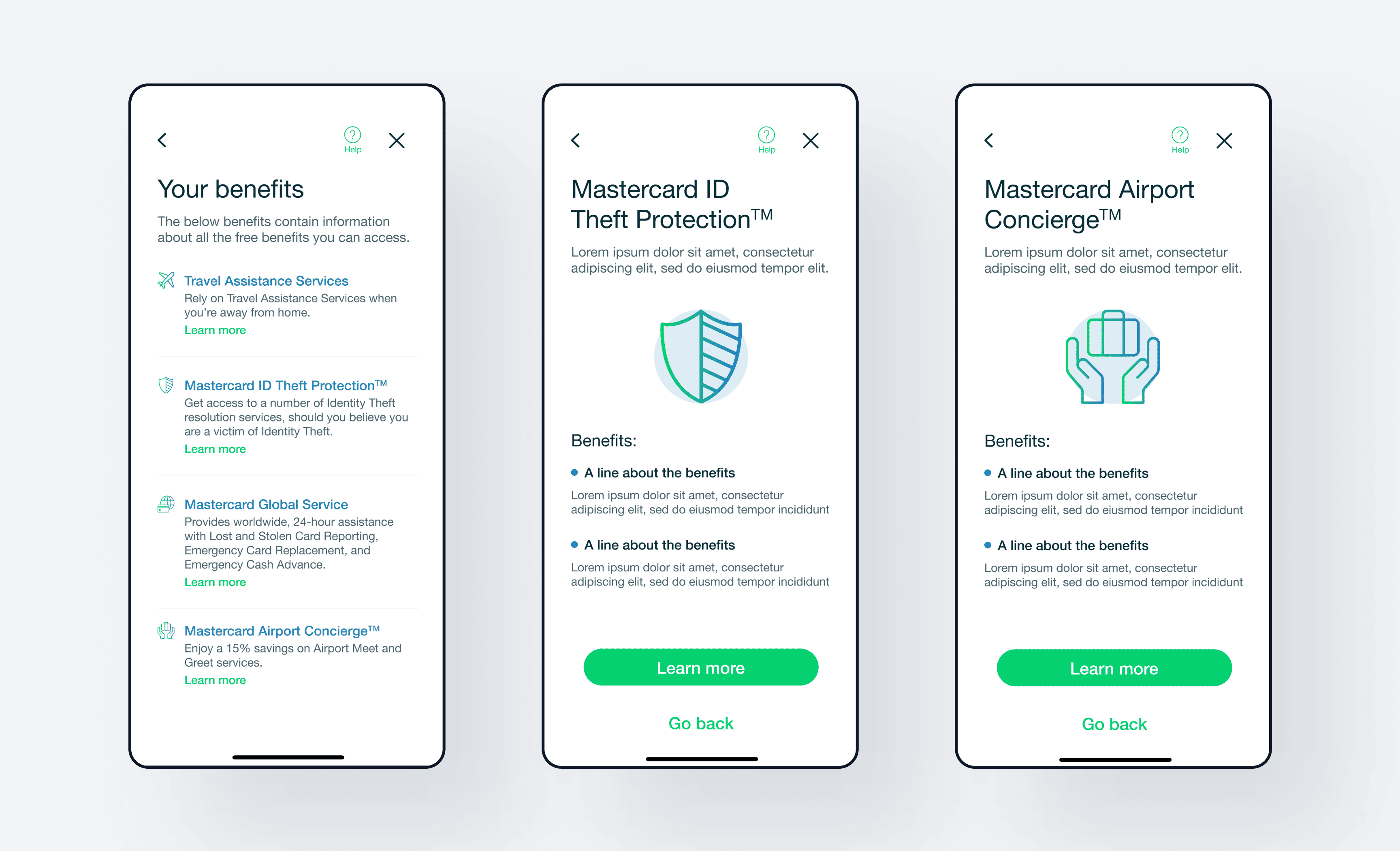

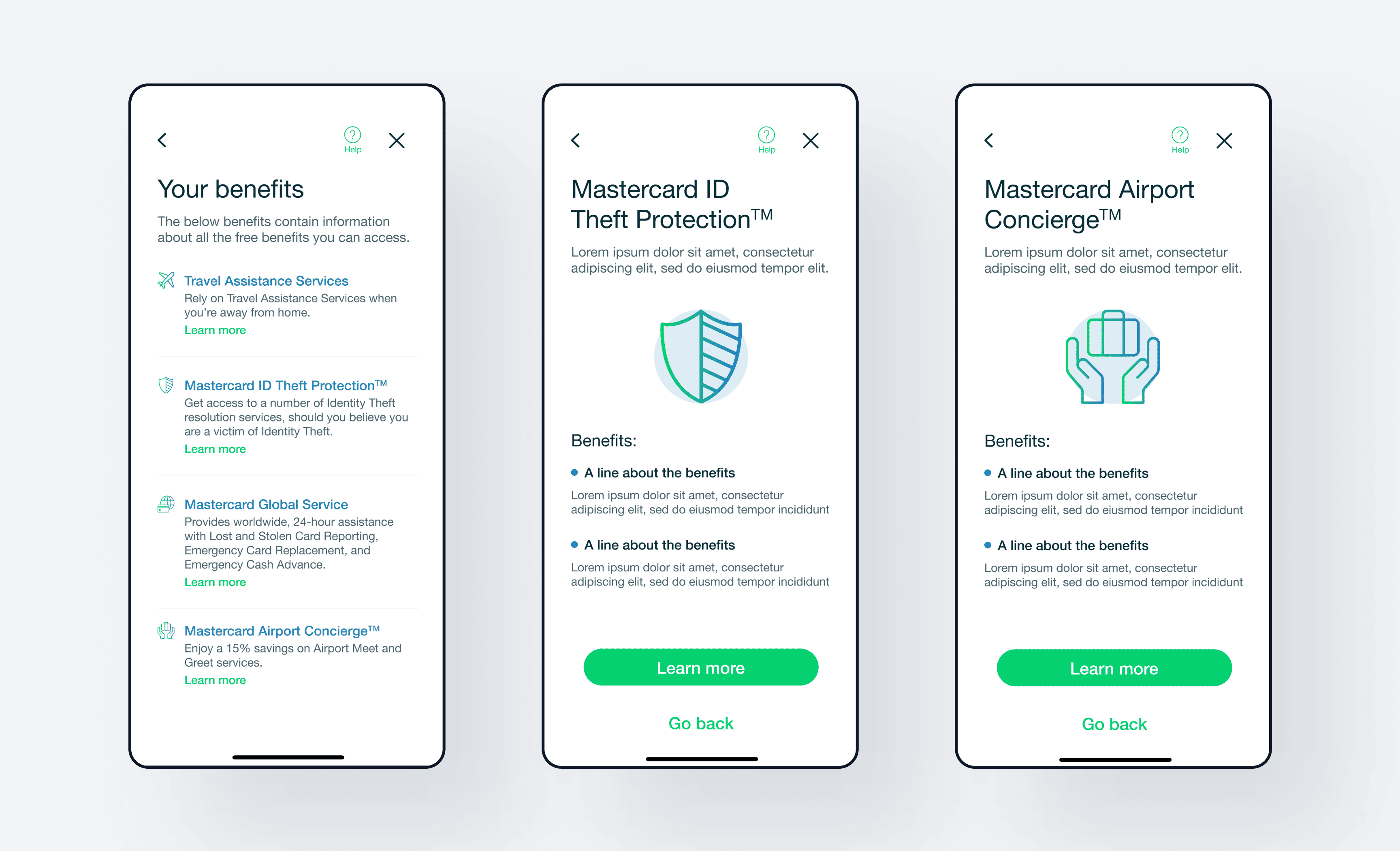

Tailored Cardholder Benefits: Created customized user flows for first-time cardholders, showcasing key benefits like travel assistance, Mastercard ID Theft Protection, and Mastercard Global Service.

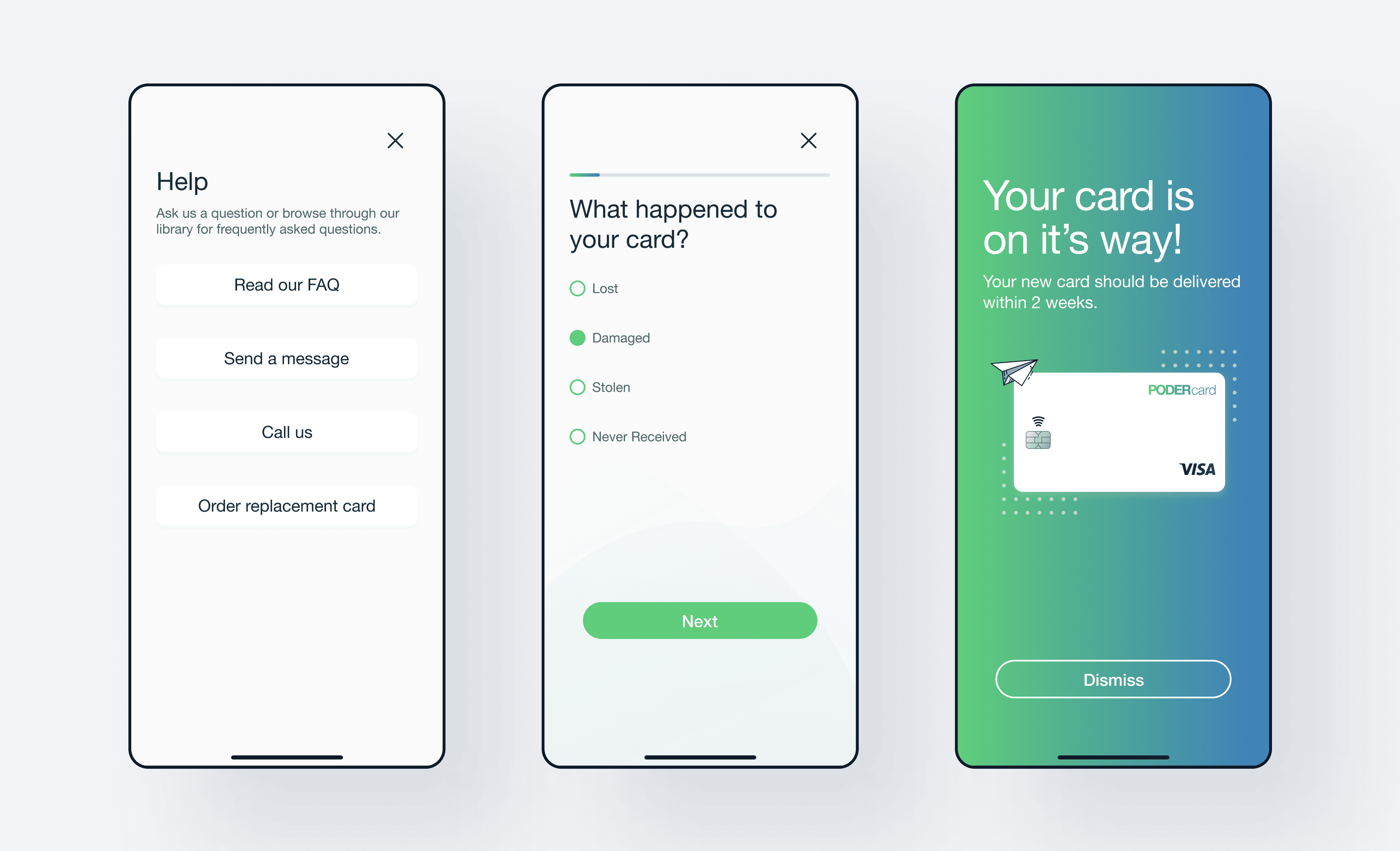

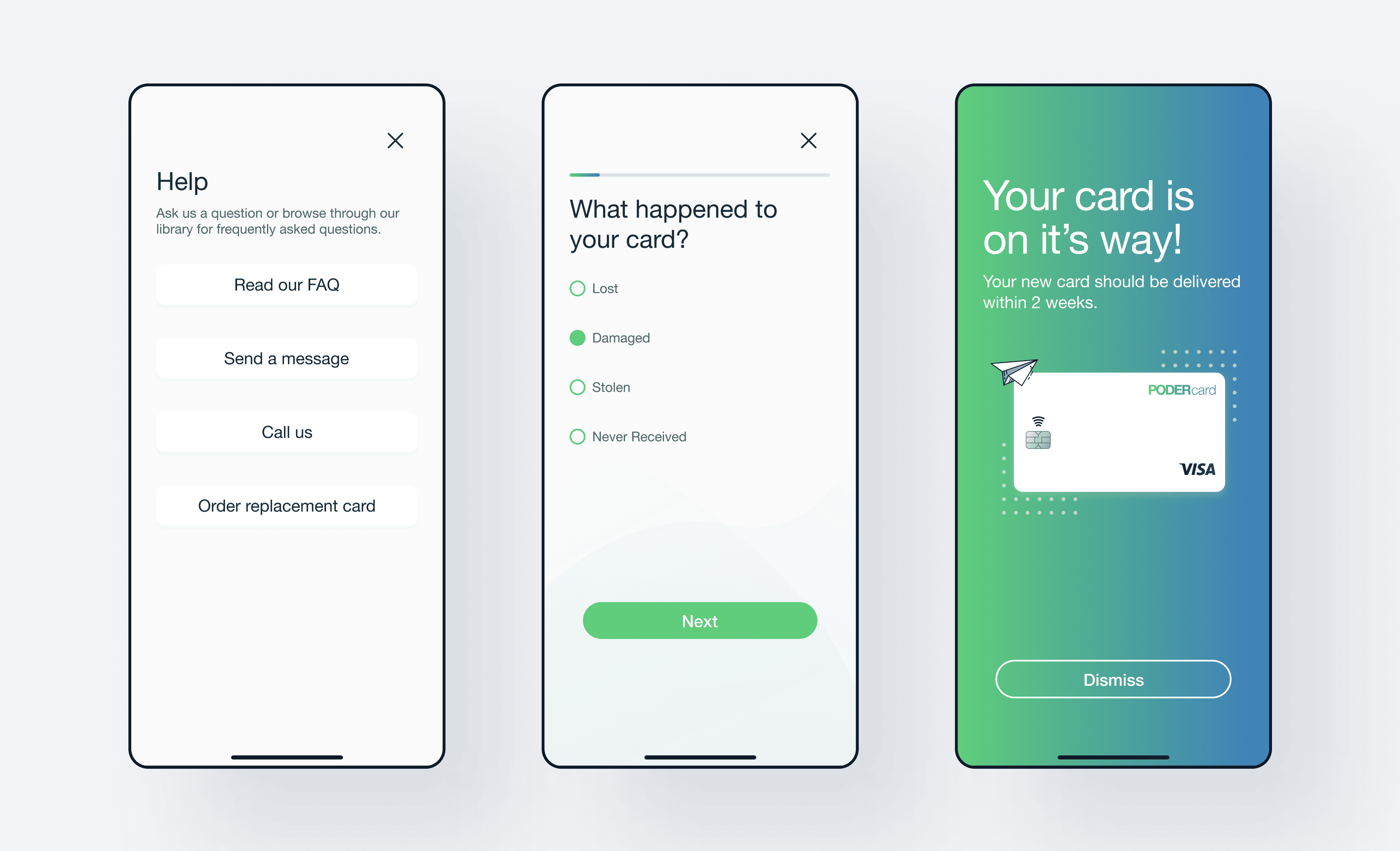

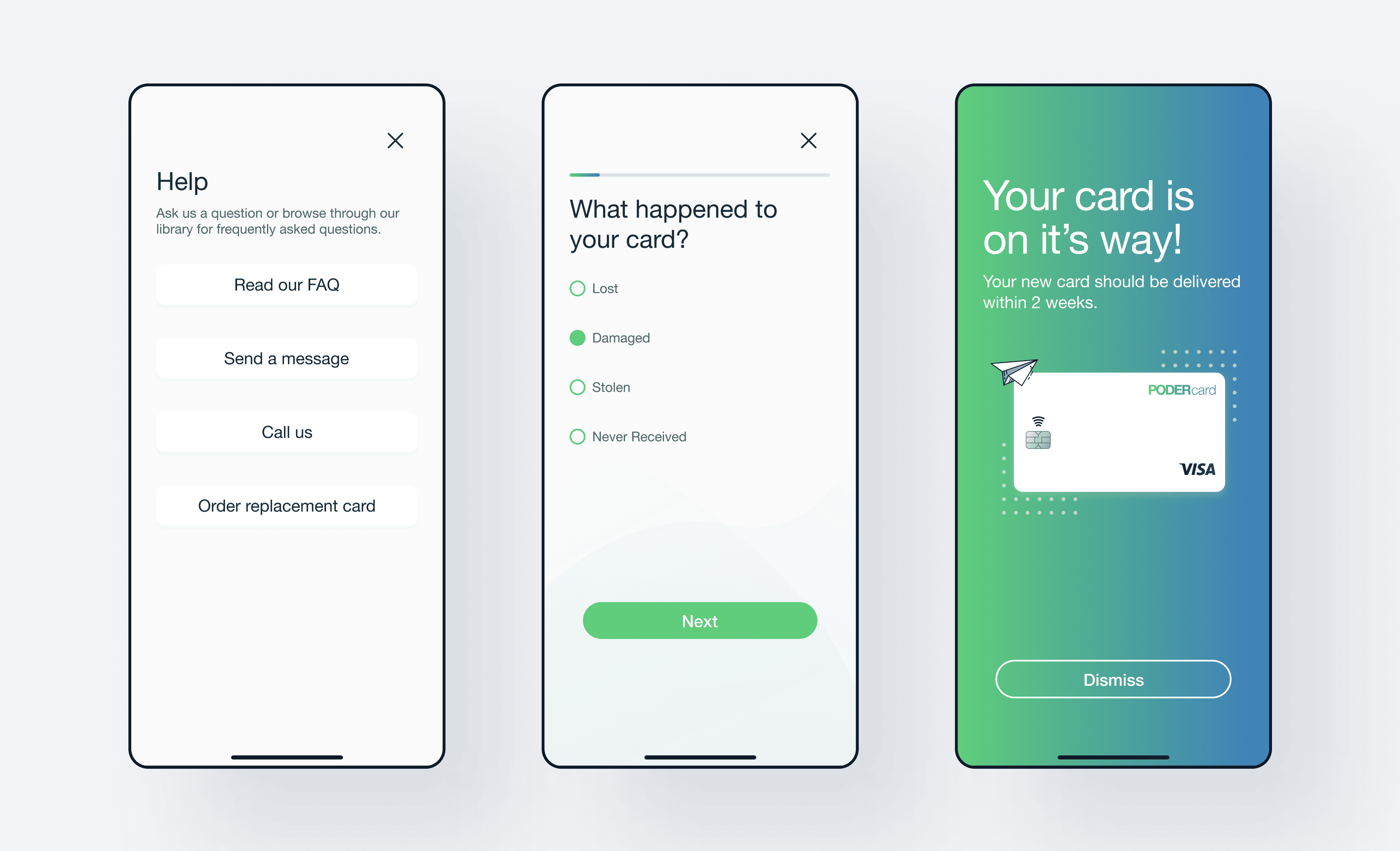

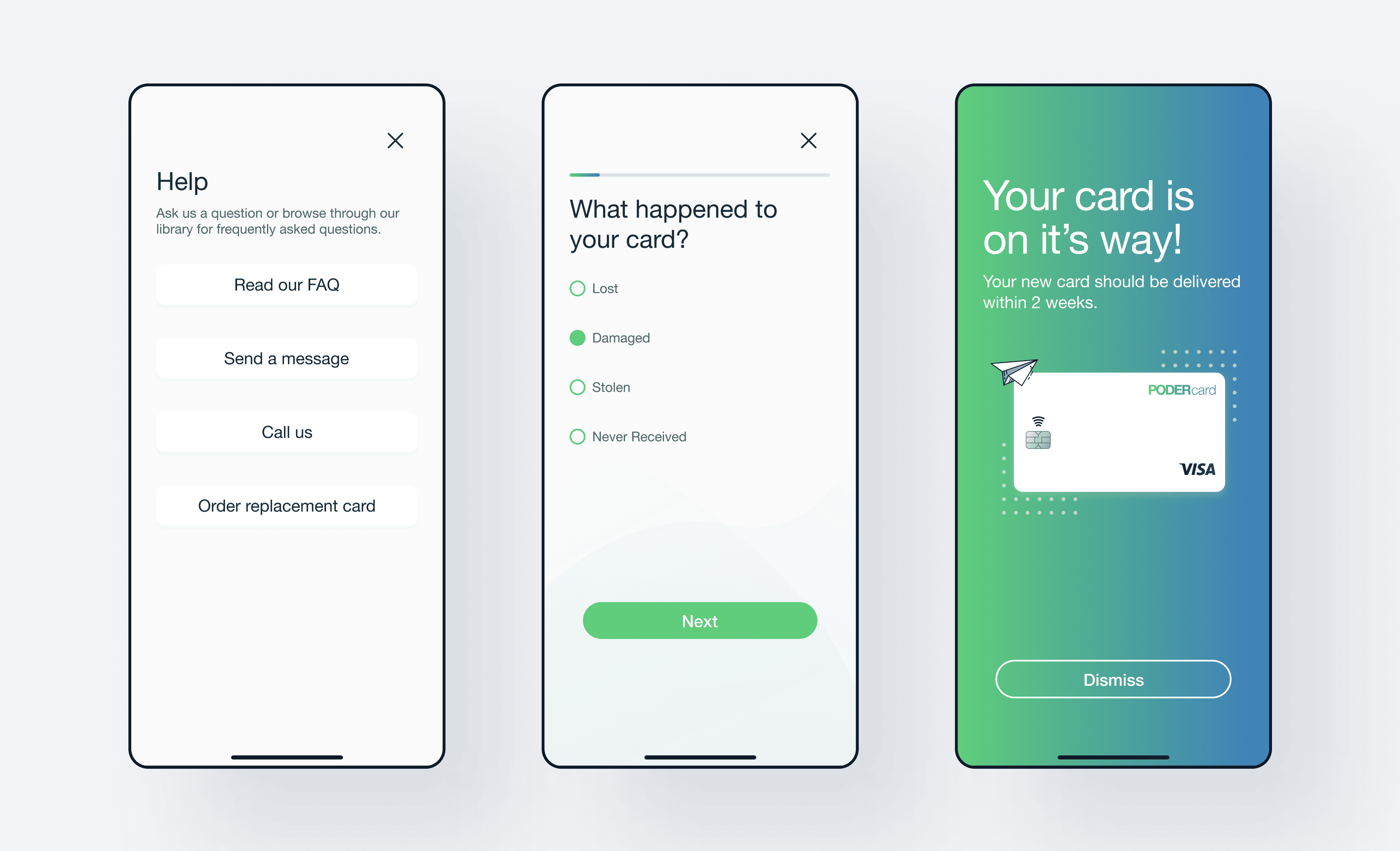

Replacement Debit Card Feature: Added a feature to order debit card replacements directly in-app, addressing a common user pain point and reducing customer service call volumes.

Outcomes

The redesigned app achieved notable results:

1.3 million organic downloads.

4.8/5 app store rating.

+77 NPS score, reflecting high user satisfaction.

Users praised the app for its simplicity and effectiveness, while stakeholders acknowledged the design’s success in meeting user needs.

Future ideas

Personalized financial education features to empower users.

Expanding features to include savings tools and investment options for diverse financial needs.

Designing a solution

I aimed to design straightforward interactions that engage users and accommodate varying levels of financial literacy.

First Time User Experience (FTUX): Developed clear screens for account creation and login, guiding users through setup with essential information.

Tailored Cardholder Benefits: Created customized user flows for first-time cardholders, showcasing key benefits like travel assistance, Mastercard ID Theft Protection, and Mastercard Global Service.

Replacement Debit Card Feature: Added a feature to order debit card replacements directly in-app, addressing a common user pain point and reducing customer service call volumes.

First-Time User Experience (FTUX)

Tailored Cardholder Benefits

Tailored Cardholder Benefits

First-Time User Experience (FTUX)

Replacement Debit Card Feature

Replacement Debit Card Feature

Outcomes

The PODERcard app achieved notable results:

1.3 million organic downloads.

4.8/5 app store rating.

+77 NPS score, reflecting high user satisfaction.

Users praised the app for its simplicity and effectiveness, while stakeholders acknowledged the design’s success in meeting user needs.

The PODERcard app achieved notable results:

1.3 million organic downloads.

4.8/5 app store rating.

+77 NPS score, reflecting high user satisfaction.

Users praised the app for its simplicity and effectiveness, while stakeholders acknowledged the design’s success in meeting user needs.

The PODERcard app achieved notable results:

1.3 million organic downloads.

4.8/5 app store rating.

+77 NPS score, reflecting high user satisfaction.

Users praised the app for its simplicity and effectiveness, while stakeholders acknowledged the design’s success in meeting user needs.

Future ideas

Personalized financial education features to empower users.

Expanding features to include savings tools and investment options for diverse financial needs.